Ankit Goyal's Forex MAMM Services

What is MAM?

MAM Accounts help the trader to manage multiple trading accounts using a single terminal. MAM accounts make use of combining individual trader accounts into a large pool of managed fund that comprises of individual trader accounts as well as investor accounts. All orders executed on the master trading account are reflected on every associated MAM account according to the parameters set by the investor. Investors also have the option of entering orders through their individual trading accounts and are free to modify MAM trades according to their preferences. The performance fee is paid to the master trader according to his performance and as a percentage of the returns. MAM account is an advanced type of managed account that offers excellent control for an investor and has several features enjoyed by both PAMM as well as LAMM accounts.

Are Managed Accounts Safe?

Managed accounts serve as a highly transparent and safe form of investment, which provides multiple levels of control for both the trader as well as the investor. Professional traders with varying degrees of expertise can offer different types of account options to investors according to the magnitude of the investment and the risk appetite. Traders are free to charge their performance fee according to their preferences, and investors have the ability to verify the performance of traders before investing in a managed fund. Investors usually have the option of investing their money in a managed fund or open separate trading accounts which can then be linked to a managed account through the broker platform. Investors enjoy the freedom to enter or exit a program without any limitations, as managed accounts don’t have any lock-in periods; therefore, traders can pull out of a managed account if they are not comfortable with the trading behavior or performance of a particular trader. Managed account investors can view a broad range of performance indicators such as trading history, profit potential, and risk factor before choosing to invest in a managed fund.

One of the most important aspects of managed accounts is the safety of funds in a managed account. Managed accounts only serve as a pool of investments that follow the trading pattern according to a set of terms and conditions. An investor can choose the trading conditions and minimize or maximize risk according to their risk appetite and trading preferences. A trader, on the other hand, doesn’t have access to investor funds as the trading is performed according to the trading parameters that are automatically determined by the managed account platform.

How is Ankit's MAM Trading different from others?

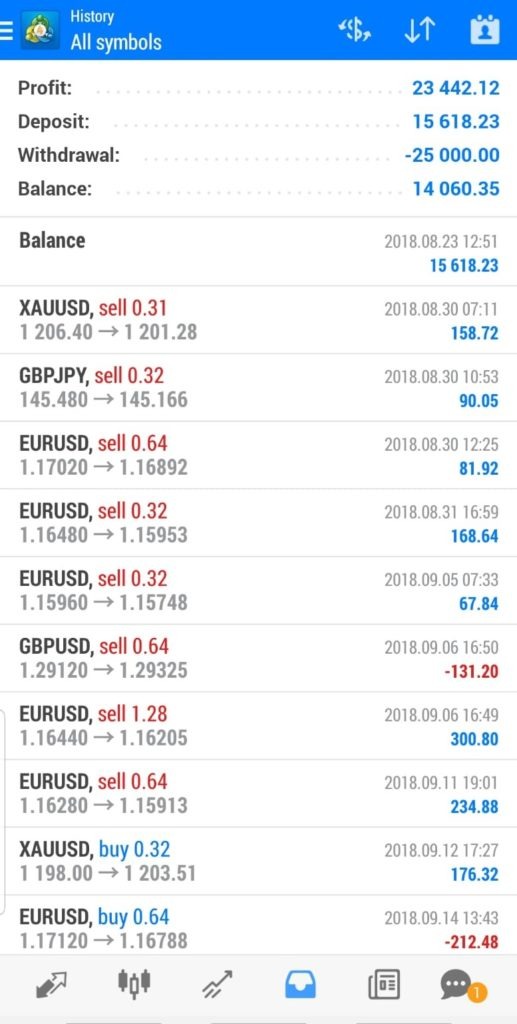

Your trading account will be connected with our mentor’s account i.e, Ankit’s Trading Account. Whatever trades he takes will automatically reflect in your Trading account on a proportional basis.

- You need not trade.

- You don’t need to have any prior knowledge or experience for MAM Trading.

- You don’t need a Huge Capital to Join.

Example: Let’s just say that he has a 10,000$ and you have a 1,000$ account. Assuming that he made 1000$ profit in his account then you will see 100$ profit in your account. It works proportionally.

Your account money remains with you and full control rests with you only.

Profit Sharing: He takes 30% share on the profits that he makes for you.

- Unlike other programs and scams, you don’t need to send any money to the trader. Simply open an account with Ankit’s IB Link with the broker of your choice and fund it, grant Ankit the permission to trade.

- Safe & Secure

- Profitable

- Reap the Benefits of Compounding

- He only earns when you do!

- Minimum Investment - 500$

- Profit Share - 30%

- Minimum Monthly Return - 10-50$

Profitable

Profit Sharing: He takes 30% share on the profits that he makes for you.

Safe & Secure

Unlike other programs and scams, you don’t need to send any money to the trader. Simply open an account with Ankit’s IB Link with the broker of your choice and fund it, grant Ankit the permission to trade.